Financing Services.

Transitional Lending is a concept reflecting how Maynbridge Capital partners with its borrowers. We offer financial products ranging across the risk spectrum, designed to appeal to companies in all stages of the business life cycle from high growth to distressed.

Through our long-used partnerships with asset valuation, we have a deep understanding of the assets in which we finance, and appropriately take an aggressive approach in how we can finance those assets.

We aim to match repayment schedules to reflect those asset values and their depreciation schedules. This philosophy allows us to provide the best possible financing solutions for those assets.

Lending across the risk spectrum

Lending Situations we Specialize in.

Mergers & Acquisitions

Management Buy-outs

CCAA and bankruptcy

Debtor-in-Possession (DIP) Financing

Bridge

Support periods of rapid growth

We underwrite tangible assets owned by any type of company, with loan values beginning at $5,000,000. Our transactions must be supported by physical assets with loan-to-value ratios determined by the particular circumstances of each situation as appropriate by risk, asset type and location. Maynbridge Capital’s mandate is to successfully guide companies through the full spectrum of what are commonly considered “riskier situations” by the general financial community.

From designing lending programs around improving a business’ cash flows and injecting of working capital, Maynbridge envisions its successful programs as reinvigorating businesses to the point that a client has the option to return to more traditional lenders when their cash flows can support it.

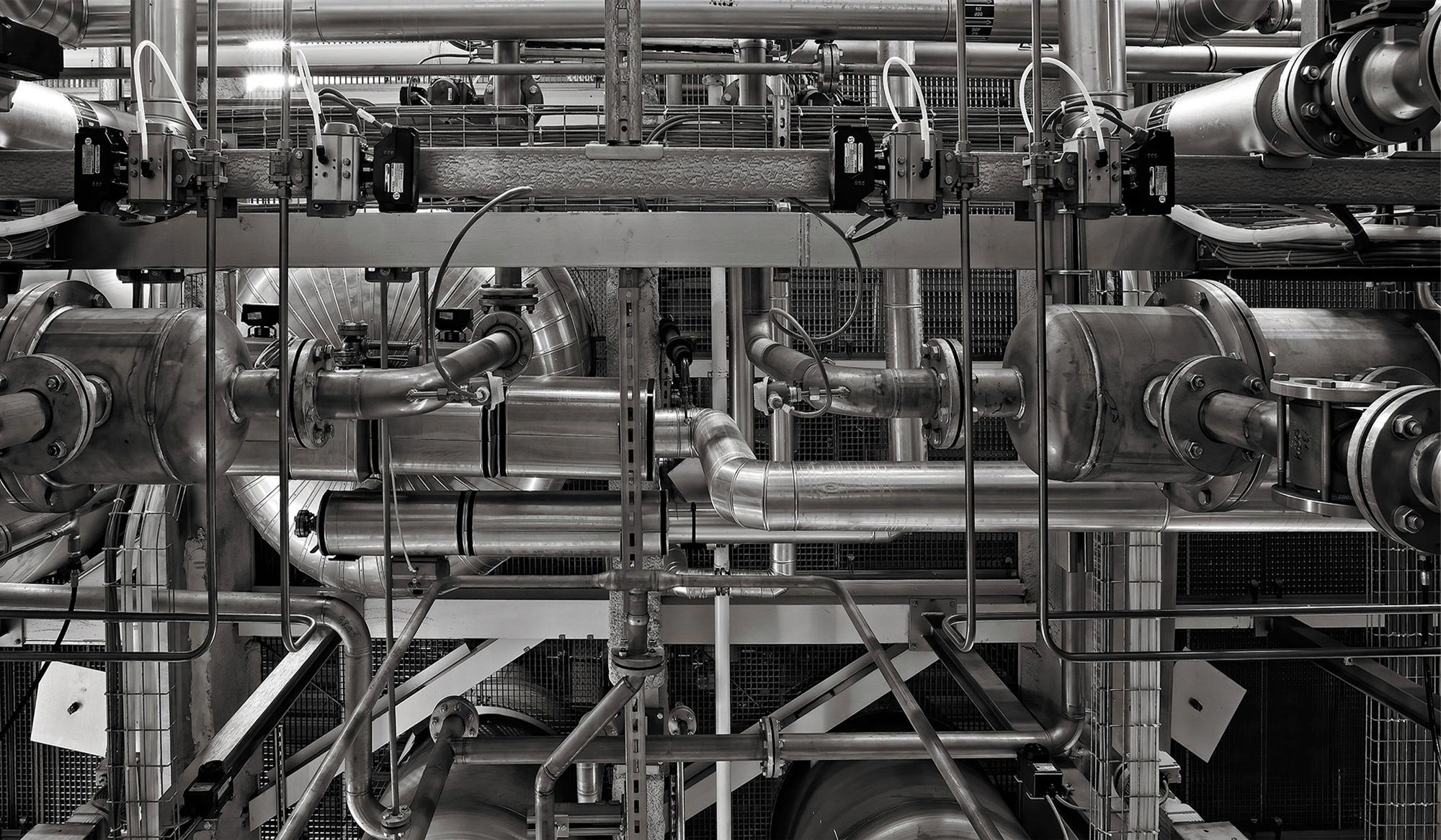

Maynbridge is a transitional lender who specializes in financing equipment, industrial properties and industrial tangible assets of all forms. Our products and terms are reflective of the situation for our clients. We are able to create many flexibile variations of our products to maximize cash flows for businesses and allow clients to strengthen their working capital from periods of high growth, right through to turnaround and distress.

Terms of our Transitional Financing Products

Our programs typically run from 12 - 24 months with interest rates reflective of the risk profile of that situation.

Equipment Financing

We are most comfortable lending into sectors where assets carry reliable depreciation schedules and with sustainable demand, including:

Aircraft

Automotive Manufacturing

Construction

Forestry

Industrial Inventory & Equipment

Machinery and Equipment

Manufacturing

Mining

Oil & Gas Services

Owner Occupied Industrial Property

Transportation

Industrial Property

Targeted investments size - $5 - 50 million

Type: Industrial / Select Commercial

Locations: Located within a major urban centre in Canada

Owner Occupied / Multi-tenant